I Want To Invest Money In Mutual Fund

10 Minute Read | September 27, 2021

If you've been following us for any amount of time, you know we're always talking about investing in mutual funds to save for retirement.

There's a lot to love about them! But maybe after researching mutual funds on your own, you're a little overwhelmed by all the details and feeling lost in the lingo. Front-loaded, end-loaded, over-loaded . . . it's no wonder you feel confused! How are you supposed to build a solid nest egg if you can't make sense of your options?

Listen, the best place to go for a complete explanation of your investing options is a financial advisor or investment professional. But while your advisor can give you some good advice, you're ultimately the one who calls the shots when it comes to your retirement and understanding what you're investing in. It's time for you to take charge!

What Are Mutual Funds?

First things first, let's define what a mutual fund actually is. Simply put, a mutual fund is created when a group of investors pool their money together to invest in something.

We filter out sleazy advisors. See up to five investing pros we trust.

Mutual funds are managed by a team of investment professionals, and this team selects a mix of investments to include in the mutual fund based on the fund's specific objective. If the fund is used to buy growth stocks, for example, then it would be called a "growth stock mutual fund." See? That's not too hard to understand!

The major benefit of mutual funds is they allow investors to invest in many different companies at once. If you have a tax-advantaged retirement savings account, like a workplace 401(k) plan or a Roth IRA, that's the easiest place to start investing in mutual funds.

How Do You Make Money From Mutual Funds?

When mutual funds increase in value, the profit is shared with the investors. That distribution can then be reinvested to buy more shares of the stock. Those shares make more profit, which can be reinvested and on and on. Everybody wins!

I want you to hear us loud and clear—the most important factor in making money from mutual funds isinvesting consistently for a long period of time. That's right, how long you keep your money invested is even more important than what funds you choose to invest in!

Will there be ups and downs investing in the stock market? Of course! But historically, most people make money in the long run if they're patient. Just look at the S&P 500, for example. The S&P 500 tracks the performance of stocks from the 500 largest, most stable companies in the U.S., and it has an average annual return between 11–12% from 1928 to 2020.1

That's why you want to use a buy-and-hold strategy when investing in mutual funds. Don't try to time the market by buying and selling based on trends. Choose investments with a long history of above-average returns, and stick with them for the long haul. Remember, saving for retirement is a marathon—not a sprint!

How Should I Invest in Mutual Funds?

Now it's time to get down to business! If you're ready to start investing in mutual funds, just follow these simple steps and you'll be well on your way:

1. Invest 15% of your income.

Wealth building takes hard work and discipline. If you want to invest for your future, you need to plan on investing consistently—no matter what the market is doing.

We recommend investing 15% of your gross income for retirement. After you've paid off all debt (except for your house) and built a solid emergency fund, you should be able to carve out 15% for your future. It might feel like a sacrifice at first, but it's worth it. Once you get in the habit of investing consistently, you'll realize you don't even miss that money!

There are no shortcuts to building wealth, but there are strategies that can help your money go further. For example, investing in mutual funds in tax-advantaged accounts through your workplace, like a 401(k), is a great way to get started. And if you get a company match on your contributions, even better. That's free money, people!

If you have a traditional 401(k) at work with a match, invest at least enough to get the match. Then, you can open a Roth IRA. With a Roth IRA, the money you invest in mutual funds goes further because you use after-tax dollars—which means you won't have to pay taxes on that money when you withdraw it in retirement. It's all yours!

The only downside to a Roth IRA is that it has lower contribution limits than a 401(k).2 It's possible to max out your Roth IRA without reaching your 15% goal. That's okay! Just go back to your 401(k) and invest the rest of your 15% there.

Have a Roth 401(k) with good mutual fund options? You can invest your whole 15% in that account if you like your investing options. Boom, you're done!

2. Diversify your investment portfolio.

Whenever someone talks to you about investing, the word diversification probably gets thrown around a lot. All diversification means is you're spreading your money out across different kinds of investments, which reduces your overall risk if a particular market goes south.

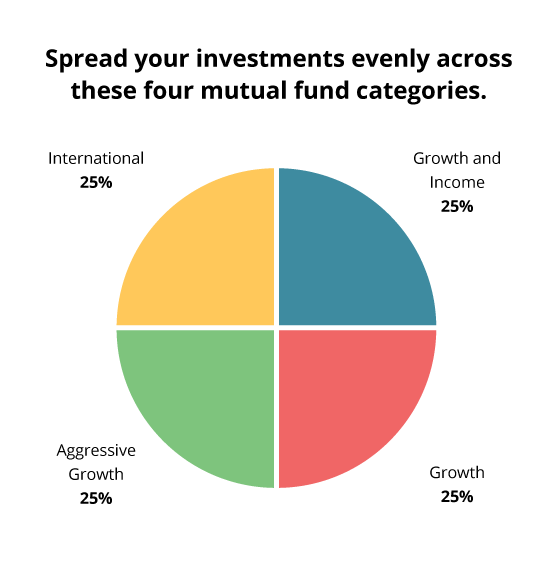

That's why we recommend spreading your investments equally across four types of mutual funds: growth and income, growth, aggressive growth, and international. Keeping your portfolio balanced helps you minimize your risks against the stock market's ups and downs. You don't want to bet your retirement on one horse!

Below are the four mutual fund categories we talk about and the reasons why we recommend them:

- Growth and income: These funds create a stable foundation for your portfolio. These can be described as big, boring American companies that have been around for a long time and offer goods and services people use regardless of the economy. With growth and income, be sure to look for funds with a history of stable growth that also pay dividends. You might find these listed under the large-cap or large value fund category. They may also be calledblue chip,dividend income orequity income funds.

- Growth: This category features medium or large U.S. companies that are experiencing growth. Unlike growth and income funds, these are more likely to ebb and flow with the economy. For instance, you might find the company that makes the latest "it" gadget or luxury item in your growth fund mix. Common labels for this category includemid-cap, equity or growth funds.

- Aggressive growth: Think of this category as the wild child of your portfolio. When these funds are up, they'reup. And when they're down, they're down. Aggressive growth funds usually invest in smaller companies. But size isn't the only consideration. Geography can also play a role. Aggressive growth could sometimes mean large companies that are based in emerging markets.

- International: International funds are great because they spread your risk beyond U.S. soil and invest in big non-U.S. companies you know and love like Trader Joe's, Firestone and Gerber. You may see these referred to asforeign oroverseas funds. Just don't get them confused with world or global funds, which group U.S. and foreign stocks together.

3. Work with an investment professional.

There's a reason why most millionaires we talked to for the National Study of Millionaires said they worked with a financial advisor or investment professional to achieve their net worth.3

A good investment professional can do two very important things. First, they can help you pick and choose what mutual funds to include in your retirement portfolio. Be clear about your goals up front so that you and your pro are on the same page before you make any decisions!

And second, they can help you sort through all the lingo and jargon of the investing world. If we've said it once, we've said it a hundred times: Never invest in anything you don't understand. No one cares about your future as much as you do, so it's in your best interest to take charge of your own mutual fund education.

Remember to take your time and interview several SmartVestor Pros before you make the decision. Hiring the right financial advisor can make all the difference!

What if you know a lot about investing, and enjoy researching your options on your own? Do you still need an advisor? Yes! Think of your advisor as a coach, but you're the owner. Ultimately, you're the one who calls the shots in the end.

4. Don't chase returns.

It can be tempting to get tunnel vision and focus only on funds or sectors that brought stellar returns in recent years. Just remember, nobody can time the market.

Before committing to a fund, take a step back and consider the big picture. How has it performed over the past five years? What about the past 10 or 20 years? Choose mutual funds that stand the test of time and continue to deliver strong long-haul returns.

5. Brush up on investing lingo.

Listen, you don't have to be an expert in investing lingo to choose the right mutual funds. But a basic understanding of some of the most common terms will help. Here's a little cheat sheet to get you started:

- Asset Allocation: The practice of spreading your investments out (diversifying) among different types of investments with the goal of minimizing investment risk while making the most of investment growth.

- Cost: Make sure you understand the fee structure that your financial advisor uses to get paid. Also, pay attention to the fund's expense ratio. A ratio higher than 1% is considered expensive.

- Large-, Medium- and Small-Cap:Cap stands for capitalization, which means money. To most investors though, it refers to the size and value of a company. Large-cap companies carry lower risk, but you'll make less money. Medium-cap companies are moderately risky, and small-cap companies are the riskiest—but have the biggest payoffs.

- Performance (Rate of Return): Again, you want a history of strong returns for any fund you choose to invest in. Focus on long-term returns—10 years or longer if possible. You're not looking for a specific rate of return, but you do want a fund that consistently outperforms most funds in its category.

- Portfolio: This is simply what your investments look like when you put them all together.

- Sectors: Sectors refer to the types of businesses the fund invests in, such as financial services or health care. A balanced distribution among sectors means the fund is well diversified.

- Turnover Ratio: Turnover refers to how often investments are bought and sold within the fund. A low turnover ratio of 50% or less shows the management team has confidence in its investments and isn't trying to time the market for a bigger return.

Getting familiar with these terms will help you feel a little more comfortable as you make investing decisions with your investing professional.

Talk With a Financial Advisor

You should always know how your money is invested and what role it plays in helping you reach your long-term goals. After all, this is your future we're talking about.

Stay engaged with how your funds are performing and regularly rebalance your portfolio. Over time, certain mutual funds can start to take up more and more room in your investment portfolio, which can expose you to risk.

If this sounds like a lot of information to dig through and compare, you're right! The good news is you don't have to do it all alone. You can work with a SmartVestor Pro who understands your goals and can help you make investment choices for your future.

Find your Smartvestor Pro!

I Want To Invest Money In Mutual Fund

Source: https://www.ramseysolutions.com/retirement/how-to-invest-in-mutual-funds

Posted by: haminedan70.blogspot.com

0 Response to "I Want To Invest Money In Mutual Fund"

Post a Comment